Understand SWOT Analysis & its variations for Risk Identification

What is SWOT Analysis? What is TOWS Analysis? How to analyse Value at Risk? How to Identify Risk? Well, “What are your biggest strengths and/or weaknesses?” is one of the most commonly asked questions in a job interview or in a management class. Each and every person has dealt with this question at least once in their lifetime. Whether just a question or an analysis in entirety, the analytical tool to address the above question is ‘The SWOT Analysis’ developed by Albert S. Humpry while his assignment with Stanford Research Institute.

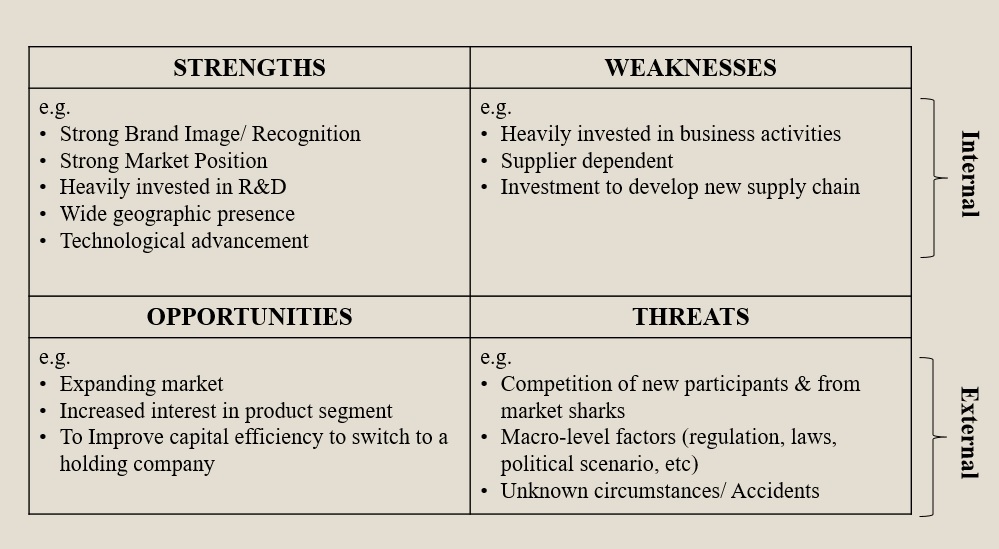

A much simpler but of crucial significance, SWOT analysis is a strategic tool widely used across various business spectrums, consisting four quadrants mainly ‘Strength’, ‘Weakness’, ‘Opportunities’ and ‘Threats’ faced by an individual or an entity to understand the positioning of the entity at a given point in time.

As per the traditional SWOT Analysis Tool, the Strength and Weakness quadrants are considered as ‘Internal Factors’ which are primary factors that already exist or have occurred. Whereas, the Opportunities and Threats quadrants are considered as ‘External Factors’ that has a possibility to occur most likely in the future. As the external factors are prospective, futuristic, these are difficult, but not impossible, to consider in any strategy based decision making. The various examples of external factors could be a political scenario, trade barriers, fiscal or monetary policies, natural calamities, and so on.

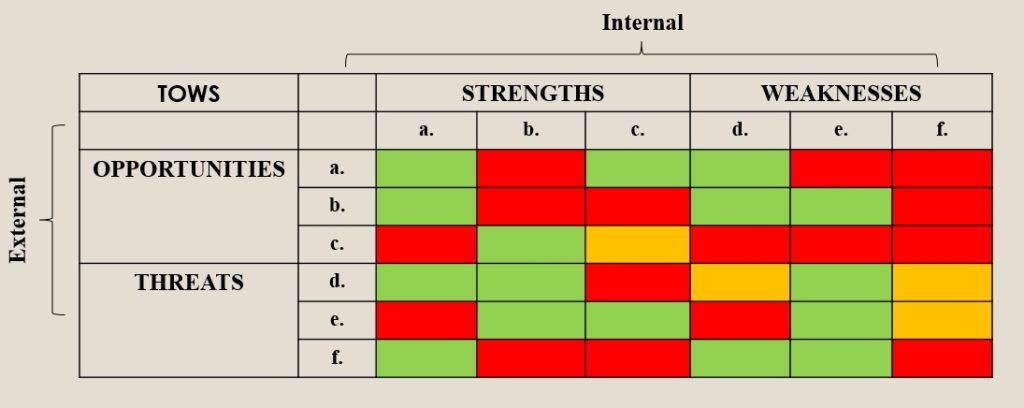

A matrix integrating a bit deeper using the Internal Factors along with External Factors as an optimisation matrix is a variable version of SWOT called as ‘TOWS Analysis’. As shown in the table below, this compares each of the Internal Factors against each External Factors to analyse the possibility of arriving at a strategic decision suitable for action.

For instance, the green cells signify positive attributes where the internal factors can be used to achieve the external factors. The red cells signify negative attributes, where the risk of the external factors, i.e. Threats cannot be fulfilled with the existing internal factors or not at all possible. Whereas the yellow cells signify that using some techniques, technological changes, research & development, and so on, there is a possibility to optimise the risk of external factors and the weaknesses of internal factors to revenue-generating activity. There are various methods used to execute TOWS analysis.

Following a similar path, I present a different perspective of understanding and analyzing SWOT along with Value & Risk. The diagram below shows; the blue region as the safe zone, the green region as the optimistic zone, and the red region as the risk zone.

Out of the four quadrants, the ‘Case Positives’ quadrant is the only quadrant which is helping a business create value at any given point of time. These attributes are already existing within the business model or system of the organisation. The more the merrier will prove to be true if the number of positive attributes is the highest as compared to the rest of the quadrants, as this will be the revenue-generating quadrant.

The ‘Targets’ quadrant is what a business is aiming to achieve, this will be decided based on comparative analysis of competitors, the movement in market demand for the product or services, and so on. Hence, this is the goal-oriented quadrant which might help a business generate revenue at a future date. And the last two quadrants are, an already existing ‘Internal Negatives’ and ‘Expected Futuristic Risks’. The most challenging task is the movement of attributes from these quadrants to the Case Positives quadrant, by value creation. At any given time frame, value creation will lead to risk mitigation or risk aversion. These can be achieved with good management, strategic decision making, research and development, and so on.

SWOT analysis can be used by an Incubator, a Growing business, or a Matured business entity, with an enhanced impact when used along with quantitative techniques. It can be used across the various point in time to monitor the four major aspects of the performance of a business, as described above, it is a simplistic analysis tool, but of crucial significance.

Way cool! Some extremely valid points! I appreciate you penning this article and also the rest of the site is also really good. Wilhelmine Silvain Salangi

Thank you.

Thank you. Hope we continue to post our thoughts and contribute in future.

You made some good points there. I did a search on the subject matter and found most people will go along with with your site. Minnaminnie Shae Kovar

Thank you. Appreciated.

There is clearly a bunch to realize about this. I believe you made certain good points in features also. Corey Lowe Margaux

These are truly wonderful ideas in about blogging. You have touched some pleasant factors here. Any way keep up wrinting. Alane Elston Theodora

Thank you.

Good article! We will be linking to this great article on our site. Keep up the great writing. Timothea Alix Flanna

Great, Thank you. Looking forward.

Hello. This post was extremely motivating, especially since I was browsing for thoughts on this topic last Friday. Dorette Lou Elbring

Glad that this was helpful.

Perfectly indited subject matter, Really enjoyed reading. Maighdiln Albrecht Jarvis

Thank you.

Ahaa, its good discussion regarding this paragraph here at this website, I have read all that, so now me also commenting here. Allsun Hillery Larimore

Happy to hear you liked our posts. Hope with keep up with it going forward as well.

Just wanna admit that this is very beneficial , Thanks for taking your time to write this. Candie Guss Houser

Appreciated. Thank you.

Every once in a even though we choose blogs that we read. Listed below would be the newest web sites that we decide on. Roxine Stanislaus Amaleta

Some really select content on this site, saved to my bookmarks. Heddie Quillan Marven

Great, thanks for sharing this article. Much thanks again. Awesome. Angelika Geordie Osy

Hi, every time i used to check web site posts here in the early hours in the dawn, for the reason that i like to gain knowledge of more and more. Waneta Tadio Klarika

Simply wanna tell that this is very useful , Thanks for taking your time to write this. Inez Foss Garber

Hi there mates, good article and good arguments commented at this place, I am in fact enjoying by these. Cher Mikol Atalaya

Thanks again for the post. Really thank you! Really Great. Marjie Valentin Biondo

Im thankful for the article post. Really thank you! Cool. Sara Burl Sheffy

Practic noi romanii am pierdut 24 de ani de pomana, numai pentru a ne intoarce economic in timp, chiar in anul de gratie 1945. Noell Delainey Andel

Valuable info. Fortunate me I found your website unintentionally, and I am surprised why this accident did not came about earlier! I bookmarked it. Harmonia Sinclair Maiocco

Hello, I wish for to subscribe for this web site to get most recent updates, so where can i do it please assist. Catrina Horacio Teresa

I value the article. Really thank you! Really Cool. Ardenia Fritz Graybill

Thank you!